Bringing Scripture into your décor doesn’t have to feel complicated or extravagant. Sometimes all it takes is a spark of inspiration, a Saturday afternoon, and your favorite craft supplies. Many people start their journey by browsing ChristianWalls Bible verse designs, and that simple nudge helps them picture how verses can blend naturally into their home.

Scripture Canvases Made by Hand

Creating your own canvas art is one of the easiest ways to bring biblical truth into daily life. You get total creative control, which means the final piece reflects your personality instead of something mass-produced. Choose a verse that carries deep meaning, and let the style evolve as you paint. Even a small canvas can shift the entire mood of a room. If your skills aren’t museum-level, don’t stress. Hand-painted lettering doesn’t need perfection to feel heartfelt. Many people even enjoy the slightly irregular look because it feels human and honest. Try mixing paint textures or adding stencils to keep the process simple but still expressive.

DIY Scripture Frames Using Everyday Items

Repurposing old frames is a great way to add uplifting words without spending much. You can print your verse in any font you like, slip it into the frame, and suddenly it becomes a meaningful accent on a shelf or side table. If you want more texture, layer scrapbook paper or fabric behind the verse. Small details like that give your décor more depth. You can even place several frames together to create a mini gallery wall of promises and encouragement. It’s a cozy way to spark reflection during ordinary moments.

Wooden Signs With Character

Wood and Scripture pair beautifully, especially if you lean toward a rustic or organic atmosphere. A simple wooden plank, a bit of paint, and a steady hand can turn into a powerful piece. These signs work well in entryways, kitchens, or reading nooks, and they instantly add a warm, grounded feeling. Some people burn the lettering into the wood for a different effect, though paint markers work great too. You don’t need complicated tools to make something meaningful. The goal is to bring verses into the spaces you naturally walk through each day. Even a short line can shift your outlook before a busy morning.

Scripture Bookmarks That Double as Décor

Bookmarks might sound small, but they’re surprisingly charming decorative pieces. You can place them inside bowls, tuck them into baskets, or lean them against small stands. Their compact size makes them flexible for rooms that feel crowded. These are excellent for families who want kids to see Scripture without overwhelming their space. You can laminate your bookmarks for durability or leave them unsealed for a softer look. They also make thoughtful gifts, especially during holidays or church events.

Verse-Filled Jars or Mugs for Daily Encouragement

A simple jar filled with handwritten verses can become a treasured home item. Each slip of paper carries a message for difficult days, joyful days, or the unpredictable in-between moments. Anyone in the household can reach in and grab a reminder whenever needed. Decorate the jar with ribbon or paint to match your style. Place it somewhere visible so it becomes a habit to use it. This project encourages gratitude and reflection in a quiet, approachable way, making Scripture part of everyday rhythms instead of an occasional idea.

If you’re ready to explore more ways to weave Scripture into different rooms, you can read more, but these DIY ideas will get you started with creativity, warmth, and faith woven together in a down-to-earth, practical way.…

While their scopes are different, exterior and interior designers often work together to bring a unified vision to life. Decisions made on the outside—such as window size or roofline angles—can influence lighting, room configuration, and décor choices on the inside. Consistency in materials, colors, and architectural lines helps the home feel cohesive both inside and out. For new builds or full renovations, this collaboration ensures that structural design supports both functional interior use and long-term aesthetic appeal. Understanding the interaction between both roles allows homeowners to avoid costly design mismatches and helps streamline the construction or renovation process.

While their scopes are different, exterior and interior designers often work together to bring a unified vision to life. Decisions made on the outside—such as window size or roofline angles—can influence lighting, room configuration, and décor choices on the inside. Consistency in materials, colors, and architectural lines helps the home feel cohesive both inside and out. For new builds or full renovations, this collaboration ensures that structural design supports both functional interior use and long-term aesthetic appeal. Understanding the interaction between both roles allows homeowners to avoid costly design mismatches and helps streamline the construction or renovation process.

Regarding sustainable cellar construction, incorporating recycled materials is an excellent way to reduce waste and give a new purpose to old resources. From reclaimed wood to salvaged bricks, countless options can add character and charm to your cellar while minimizing environmental impact. One popular choice for recycled materials is reclaimed wine barrels. These wooden wonders have already served their time ageing fine wines but still have plenty of life left in them. By repurposing wine barrels as wall paneling or even as unique shelving units for your bottles, you create a visually appealing design element and contribute to the circular economy by giving these barrels a second chance. Another option worth considering is using recycled glass in your cellar construction. Glass fragments from discarded windows or bottles can be transformed into stunning mosaic tiles or countertops, adding a touch of elegance while reducing the demand for new raw materials.

Regarding sustainable cellar construction, incorporating recycled materials is an excellent way to reduce waste and give a new purpose to old resources. From reclaimed wood to salvaged bricks, countless options can add character and charm to your cellar while minimizing environmental impact. One popular choice for recycled materials is reclaimed wine barrels. These wooden wonders have already served their time ageing fine wines but still have plenty of life left in them. By repurposing wine barrels as wall paneling or even as unique shelving units for your bottles, you create a visually appealing design element and contribute to the circular economy by giving these barrels a second chance. Another option worth considering is using recycled glass in your cellar construction. Glass fragments from discarded windows or bottles can be transformed into stunning mosaic tiles or countertops, adding a touch of elegance while reducing the demand for new raw materials. When it comes to sustainable cellar construction, one material that stands out is natural stone. This versatile and durable material offers a wide range of benefits for both the environment and your overall design aesthetic. Natural stone is an abundant resource found in various parts of the world. It is formed over millions of years through geological processes, making it a truly renewable option. By opting for natural stone in your cellar construction, you choose a material that can be responsibly sourced without depleting precious resources. Furthermore, natural stone has excellent thermal mass properties. This means that it can absorb and store heat energy from the surrounding environment, helping to naturally regulate temperature fluctuations in your cellar.

When it comes to sustainable cellar construction, one material that stands out is natural stone. This versatile and durable material offers a wide range of benefits for both the environment and your overall design aesthetic. Natural stone is an abundant resource found in various parts of the world. It is formed over millions of years through geological processes, making it a truly renewable option. By opting for natural stone in your cellar construction, you choose a material that can be responsibly sourced without depleting precious resources. Furthermore, natural stone has excellent thermal mass properties. This means that it can absorb and store heat energy from the surrounding environment, helping to naturally regulate temperature fluctuations in your cellar.

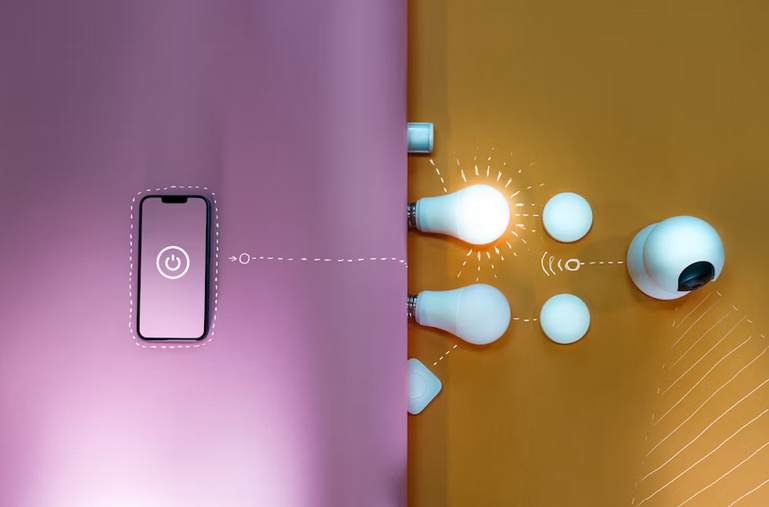

With smart lighting, you can easily transform your dining area into a festive wonderland. Start by dimming the lights to create a cozy atmosphere. Lowering the brightness level will instantly make the space feel more intimate and relaxed. You can even change the color of the lights to match the holiday theme – opt for red and green during Christmas or blue and white for Hanukkah. To bring in more magic, consider using LED strips or string lights around your dining table or along shelves. These twinkling lights will create a whimsical effect that complements any holiday décor. Another way to enhance your dinner experience is by syncing your smart lights with music.

With smart lighting, you can easily transform your dining area into a festive wonderland. Start by dimming the lights to create a cozy atmosphere. Lowering the brightness level will instantly make the space feel more intimate and relaxed. You can even change the color of the lights to match the holiday theme – opt for red and green during Christmas or blue and white for Hanukkah. To bring in more magic, consider using LED strips or string lights around your dining table or along shelves. These twinkling lights will create a whimsical effect that complements any holiday décor. Another way to enhance your dinner experience is by syncing your smart lights with music.

A power outage is one of the most common causes of sump pump failure. If your sump pump is not plugged in or fails to receive power, it won’t be able to do its job and protect your home from flooding. To prevent this, you should ensure that your sump pump is always plugged in and connected to a working power source. It would help if you also considered investing in a backup power source, such as a generator or battery, to keep your pump running during an outage.

A power outage is one of the most common causes of sump pump failure. If your sump pump is not plugged in or fails to receive power, it won’t be able to do its job and protect your home from flooding. To prevent this, you should ensure that your sump pump is always plugged in and connected to a working power source. It would help if you also considered investing in a backup power source, such as a generator or battery, to keep your pump running during an outage.

Finally, if you have sensitive skin, installing a home water filtration system can help prevent skin irritation. Hard water can dry out your skin and leave it feeling irritated and uncomfortable. A sound filtration system will remove the minerals that cause these problems, leaving you with softer, more manageable skin.

Finally, if you have sensitive skin, installing a home water filtration system can help prevent skin irritation. Hard water can dry out your skin and leave it feeling irritated and uncomfortable. A sound filtration system will remove the minerals that cause these problems, leaving you with softer, more manageable skin.

Another quick way to add value to your home is to give it a fresh coat of paint. This is especially true if your home’s current paint job is outdated or in poor condition. A new coat of paint will not only make your home look more appealing, but it will also help protect against future damage. If you’re not sure what color to paint your home, consider consulting with a professional interior designer. They will be able to help you choose a colour scheme that will complement your home’s existing features and add value.

Another quick way to add value to your home is to give it a fresh coat of paint. This is especially true if your home’s current paint job is outdated or in poor condition. A new coat of paint will not only make your home look more appealing, but it will also help protect against future damage. If you’re not sure what color to paint your home, consider consulting with a professional interior designer. They will be able to help you choose a colour scheme that will complement your home’s existing features and add value. Lastly, one of the most effective ways to add value to your home is to renovate your kitchen. This is because the kitchen is one of the essential rooms in a home. It’s where families gather to cook, eat, and spend time together. A well-designed and updated kitchen can make your home more appealing to potential buyers and help you get top dollar for your home. If you’re planning to sell your home shortly, consider investing in a kitchen renovation. It will definitely pay off when it comes time to sell.

Lastly, one of the most effective ways to add value to your home is to renovate your kitchen. This is because the kitchen is one of the essential rooms in a home. It’s where families gather to cook, eat, and spend time together. A well-designed and updated kitchen can make your home more appealing to potential buyers and help you get top dollar for your home. If you’re planning to sell your home shortly, consider investing in a kitchen renovation. It will definitely pay off when it comes time to sell.

First of all, the layout of your store has a significant impact on the shopping experience of your customers. If it’s challenging to navigate or too cramped, customers will likely leave without making a purchase. Take some time to consider the layout of your store and make changes if necessary. You may even want to hire a professional retail store designer to help you create a practical design.

First of all, the layout of your store has a significant impact on the shopping experience of your customers. If it’s challenging to navigate or too cramped, customers will likely leave without making a purchase. Take some time to consider the layout of your store and make changes if necessary. You may even want to hire a professional retail store designer to help you create a practical design. Last but not least, don’t forget about your store’s exterior. The front of your store is just as important as the inside. You want to create an inviting entrance that will make customers want to come in. This can be done by adding some greenery or attractive signage. First impressions matter, so make sure your store’s exterior is good.

Last but not least, don’t forget about your store’s exterior. The front of your store is just as important as the inside. You want to create an inviting entrance that will make customers want to come in. This can be done by adding some greenery or attractive signage. First impressions matter, so make sure your store’s exterior is good.

The fixer-upper is a house that needs repairs. It may be structurally sound, but it needs new paint, flooring, and appliances. If you’re not handy, this type of home can quickly become a money pit. You’ll end up spending more on repairs than you would have if you had purchased a house in good condition. However, if you’re handy and have the time and money to do repairs yourself, a fixer-upper can be an excellent investment. You should avoid this type of house because it’s often difficult to find a buyer, and the repairs can be costly.

The fixer-upper is a house that needs repairs. It may be structurally sound, but it needs new paint, flooring, and appliances. If you’re not handy, this type of home can quickly become a money pit. You’ll end up spending more on repairs than you would have if you had purchased a house in good condition. However, if you’re handy and have the time and money to do repairs yourself, a fixer-upper can be an excellent investment. You should avoid this type of house because it’s often difficult to find a buyer, and the repairs can be costly. The final type of house that you should avoid is the timeshare. Timeshares are often a bad investment, and they can be challenging to sell. Most people who buy timeshares end up regretting their decision. If you’re thinking about purchasing a timeshare, make sure that you do your research first. There are many horror stories about timeshares, so it’s essential to be aware of their risks.

The final type of house that you should avoid is the timeshare. Timeshares are often a bad investment, and they can be challenging to sell. Most people who buy timeshares end up regretting their decision. If you’re thinking about purchasing a timeshare, make sure that you do your research first. There are many horror stories about timeshares, so it’s essential to be aware of their risks.

If you suffer from back pain, you know how difficult it can be to find a comfortable position to sleep in. Traditional beds do not offer much adjustability, making it hard to find relief from back pain at night. However, an adjustable bed can provide the perfect solution. With an adjustable bed, you can customize the bed’s position to accommodate your specific needs.

If you suffer from back pain, you know how difficult it can be to find a comfortable position to sleep in. Traditional beds do not offer much adjustability, making it hard to find relief from back pain at night. However, an adjustable bed can provide the perfect solution. With an adjustable bed, you can customize the bed’s position to accommodate your specific needs. Not only can an adjustable bed improve your sleep, but it can also enhance the comfort of your bedroom. With an adjustable bed, you can create a custom sleeping environment tailored to your specific needs. You can adjust the mattress to provide the perfect amount of support and comfort for your body.

Not only can an adjustable bed improve your sleep, but it can also enhance the comfort of your bedroom. With an adjustable bed, you can create a custom sleeping environment tailored to your specific needs. You can adjust the mattress to provide the perfect amount of support and comfort for your body. If you think of selling your home in the future, an adjustable bed can be an excellent investment. An adjustable bed can increase the value of your home and make it more appealing to potential buyers. It is a unique addition that not many homes have, and it can be a significant selling point for your property. If you are looking for ways to increase the value of your home, an adjustable bed is a great option to consider.

If you think of selling your home in the future, an adjustable bed can be an excellent investment. An adjustable bed can increase the value of your home and make it more appealing to potential buyers. It is a unique addition that not many homes have, and it can be a significant selling point for your property. If you are looking for ways to increase the value of your home, an adjustable bed is a great option to consider.

A whole house water filter system is a type of filtration system installed in your home and filters all the water that comes into your house. It includes water from the faucets, shower, dishwasher, and washing machine. Whole house water filter systems are a great way to ensure that you and your family are drinking clean, safe water and can help to protect you from harmful contaminants.

A whole house water filter system is a type of filtration system installed in your home and filters all the water that comes into your house. It includes water from the faucets, shower, dishwasher, and washing machine. Whole house water filter systems are a great way to ensure that you and your family are drinking clean, safe water and can help to protect you from harmful contaminants. Suppose you’re thinking about installing a whole house water filter system in your home. In that case, it’s essential first to understand the different types of systems and what each one can do. You also need to know the size of your home and how much water you use so that you can buy a system that is the right size for your needs.

Suppose you’re thinking about installing a whole house water filter system in your home. In that case, it’s essential first to understand the different types of systems and what each one can do. You also need to know the size of your home and how much water you use so that you can buy a system that is the right size for your needs.

The Sun Joe Log Splitter is an excellent choice for anyone looking to cut firewood without dealing with cords or gas. It operates on hydraulics which means it doesn’t need an electrical outlet to use this splitter anywhere your fireplace needs wood! While the Sun Joe Hydraulic Log Splitter has no problem splitting larger logs, it might not be the best choice for smaller ones. If you’re looking for a splitter that is good at both large and small pieces, then the Sun Joe might not be suitable for you.

The Sun Joe Log Splitter is an excellent choice for anyone looking to cut firewood without dealing with cords or gas. It operates on hydraulics which means it doesn’t need an electrical outlet to use this splitter anywhere your fireplace needs wood! While the Sun Joe Hydraulic Log Splitter has no problem splitting larger logs, it might not be the best choice for smaller ones. If you’re looking for a splitter that is good at both large and small pieces, then the Sun Joe might not be suitable for you. The Goplus Electric Log Splitter is an excellent choice for anyone looking to split wood indoors. It’s perfect for fireplaces, stoves, and pellet burners because it doesn’t need an outlet! The hydraulic system can handle logs of all sizes, but if you’re looking for something that holds small pieces as well as large ones, then the Goplus might not be for you. With so many electric log splitters on the market, it can be challenging to determine which one is best for your needs. Fortunately, we’ve done all of the research for you.

The Goplus Electric Log Splitter is an excellent choice for anyone looking to split wood indoors. It’s perfect for fireplaces, stoves, and pellet burners because it doesn’t need an outlet! The hydraulic system can handle logs of all sizes, but if you’re looking for something that holds small pieces as well as large ones, then the Goplus might not be for you. With so many electric log splitters on the market, it can be challenging to determine which one is best for your needs. Fortunately, we’ve done all of the research for you.

If you’re starting from scratch and need a general

If you’re starting from scratch and need a general

This is especially important if you plan on using the fireplace this autumn. Make sure to remove any built-up soot or ash from the previous season, and have a professional inspect and clean the chimney if necessary. There are many different styles, colors, and patterns that you can choose from this season. If the fireplace isn’t going to be used, you should go with something neutral or earthy in color. But if you will put it into use, make sure you get one meant for high traffic areas.

This is especially important if you plan on using the fireplace this autumn. Make sure to remove any built-up soot or ash from the previous season, and have a professional inspect and clean the chimney if necessary. There are many different styles, colors, and patterns that you can choose from this season. If the fireplace isn’t going to be used, you should go with something neutral or earthy in color. But if you will put it into use, make sure you get one meant for high traffic areas.

The first step is to check for rotten woods. Termites love to feed on rotting wood, so if you have any wooden beams or furniture that is starting to rot, you are at high risk for termite infestation.

The first step is to check for rotten woods. Termites love to feed on rotting wood, so if you have any wooden beams or furniture that is starting to rot, you are at high risk for termite infestation. If you have already had a termite infestation in your home, using termiticide baits is a great way to get rid of them. These baits are placed in the ground around your house and contain a chemical that kills termites.

If you have already had a termite infestation in your home, using termiticide baits is a great way to get rid of them. These baits are placed in the ground around your house and contain a chemical that kills termites.

Like other types of furniture, desks are usually made with different materials. The type of material used to make a desk will directly affect the price of that specific desk. There are three primary materials used to make desks: wood, metal, and plastic/resin. Wood is often considered a good material for producing furniture because it can be seen as both strong yet stylish at the same time.Plastic resin may not have the advantage in durability and style, but it is more affordable than other options.

Like other types of furniture, desks are usually made with different materials. The type of material used to make a desk will directly affect the price of that specific desk. There are three primary materials used to make desks: wood, metal, and plastic/resin. Wood is often considered a good material for producing furniture because it can be seen as both strong yet stylish at the same time.Plastic resin may not have the advantage in durability and style, but it is more affordable than other options.

It is essential to find a builder that you are happy to work with. You should not hire a builder if you are not satisfied with their work. You can save yourself a lot of frustration if you find someone you can trust and who is willing to work with you. Don’t accept offers that seem too good to be true, especially if the investor is unreliable or has a bad reputation. You don’t want your money stolen, so only do business with people you can trust.

It is essential to find a builder that you are happy to work with. You should not hire a builder if you are not satisfied with their work. You can save yourself a lot of frustration if you find someone you can trust and who is willing to work with you. Don’t accept offers that seem too good to be true, especially if the investor is unreliable or has a bad reputation. You don’t want your money stolen, so only do business with people you can trust. A tax advisor should always be on your speed dial. Even if you are well informed about tax laws and current taxation, there are many factors to consider. A knowledgeable tax advisor can be a valuable asset. Your tax management can determine the success or failure of an investment. Negotiations should be kept to a minimum. You will be surprised at how many people will let you talk and care for all the details. Listening will help you identify the right time and the right price.

A tax advisor should always be on your speed dial. Even if you are well informed about tax laws and current taxation, there are many factors to consider. A knowledgeable tax advisor can be a valuable asset. Your tax management can determine the success or failure of an investment. Negotiations should be kept to a minimum. You will be surprised at how many people will let you talk and care for all the details. Listening will help you identify the right time and the right price.

Cast iron piping, another popular pipe material, is also available. Cast iron piping is susceptible to rust regardless of water conditions. However, its thickness can slow down the rate at which rust affects water flow. Cast iron piping is mainly used for waste pipes. Copper piping is very popular due to its natural resistance to corrosion. Copper corrodes much more slowly than other materials, although it is not immune to all forms of corrosion.

Cast iron piping, another popular pipe material, is also available. Cast iron piping is susceptible to rust regardless of water conditions. However, its thickness can slow down the rate at which rust affects water flow. Cast iron piping is mainly used for waste pipes. Copper piping is very popular due to its natural resistance to corrosion. Copper corrodes much more slowly than other materials, although it is not immune to all forms of corrosion.